|

OPTIONS GLOSSARY

The purpose of these definitions is to serve as a general guide for the understanding of the terms in this web page. SCA Mecanica, S.A. does not make any guarantee about the reliability of the information described below nor in the rest of this web page. For more detailed information, consult the bibliography and/or the CBOE web page. To view their glossary, click here. The Chicago Mercantile Exchange web page also features a glossary that can be reached by clicking here. Any questions, please contact us

A

B

C

E

F

I

L

M

O

P

S

T

W

- American Options Options that can be exercised at any time prior to and including the expiration date.Top

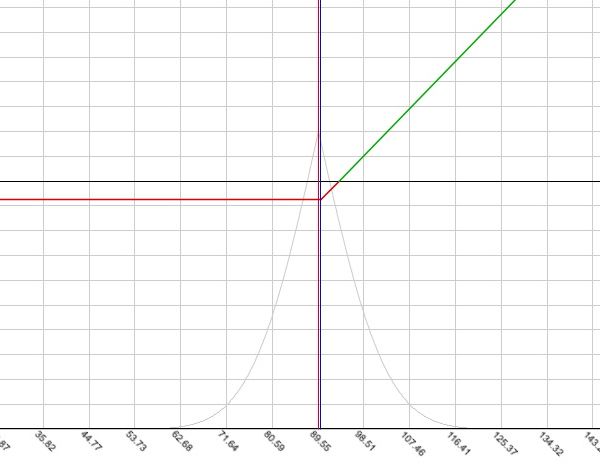

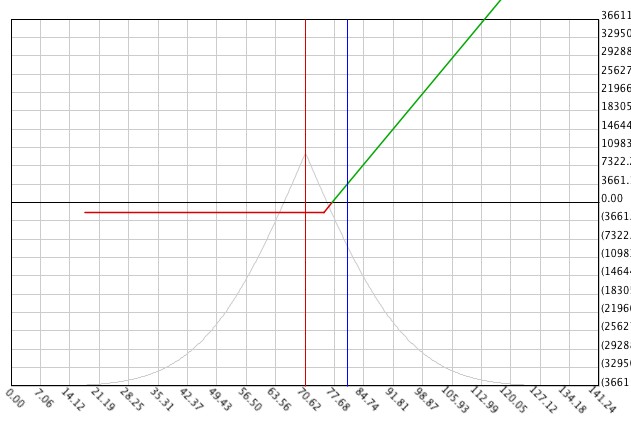

- At the money option Option where the exercise or strike price of the option and the current stock price are the same. See chart below for an example of an at-the-money Call option. The vertical line in the middle marks the current stock price, which is the same as the exercise price, where the Profit-Loss curve changes from horizontal to inclined. The horizontal section of the curve shows the area where the option cannot be exercised, while the inclined portion represents the stock prices where it can.Top

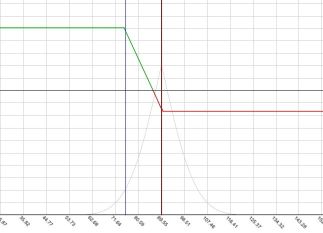

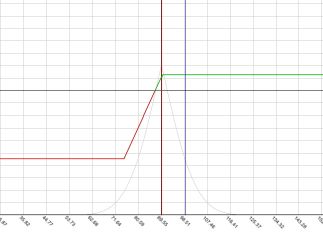

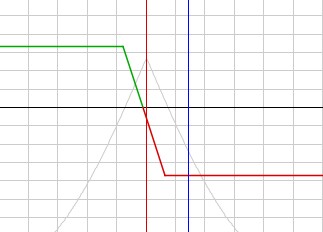

- Bear Spread strategy (Calls Bear Spread) Options strategy in which the investor buys a Call and sells a Call with the same Expiration and underlying asset at a lower strike price. (Puts Bear Spread) Options strategy in which the investor sells a Put and buys a Put with the same Expiration and underlying asset but at a lower strike price. In both cases, the investor is expecting the stock price to fall (i.e. is bearish). See charts below.Top

|

|

| Calls Bear Spread |

Puts Bear Spread |

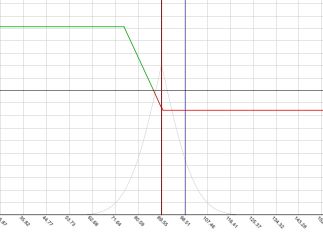

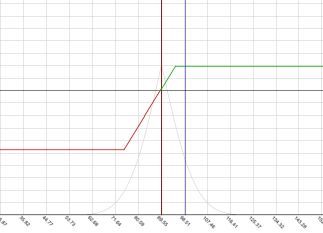

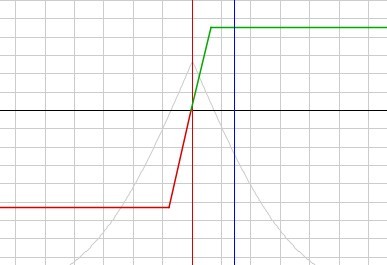

- Bull Spread strategy (Calls Bull Spread) Options strategy in which the investor sells a Call and buys a Call with the same Expiration and underlying asset but at a lower strike price. (Puts Bull Spread) Options strategy in which the investor buys a Put and sells a Put with the same Expiration and underlying asset but at a lower strike price. In both cases, the investor expects the stock price to rise (i.e. is bullish). See charts below.Top

|

|

| Calls Bull Spread |

Puts Bull Spread |

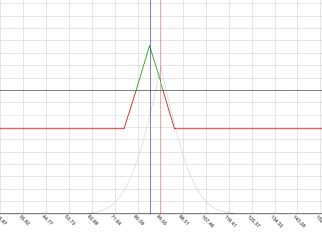

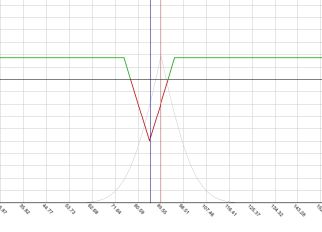

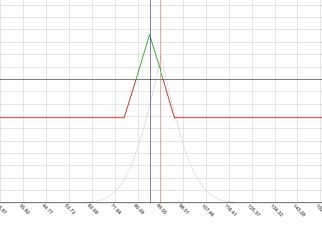

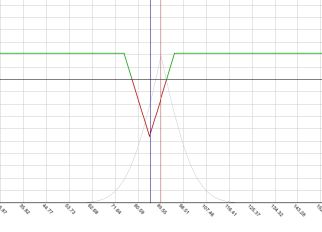

- Butterfly strategy Long Calls (Puts) Butterfly Options strategy in which the investor buys two different Calls (Puts) with a low Strike price and a High Strike price. respectively and sells two Calls (Puts) with one Strike price in between the two options mentioned before. All options involved require the same Expiration and underlying asset. Short Calls (Puts) Butterfly Options strategy in which the investor sells two different Calls (Puts) with a low Strike price and a High Strike price. respectively and buys two Calls (Puts) with one Strike price in between the two options mentioned before. All options involved require the same Expiration and underlying asset. See the charts below for examples of Butterfly options strategies. Top

|

|

| Long Calls Butterfly |

Short Calls Butterfly |

|

|

| Long Puts Butterfly |

Short Puts Butterfly |

- Calendar Spread Options strategy where the investor sells options with a near expiration date and buys the same number of options with the same strike price but with a later expiration date. As with other strategies, all options involve the same underlying asset.Top

- Call Option Contract where the buyer has the right (but not the obligation) to buy an underlying asset at a predetermined price. The chart below shows the profit/loss chart for a call if exercised. Note that the person who buys the call can lose up to the amount that was paid for the call (flat negative line) but can earn an amount proportional to the increase in the asset price (increasing slope). Top

- CBOE Chicago Board Options Exchange. Options market located physically in Chicago, Illinois, USA where the Options relevant to this program are listed.Top

- Collar Strategy (Long Collar) Options strategy in which the investor owns or buys stock, sells a Call out-of-the-money and buys a Put out-of-the-money. (Short Collar) Options strategy in which the investor sells stock, buys a Call out-of-the-money and sells a Put out-of-the-money. The amount of Options per stock is 1 per 100. Needless to say, the expiration dates and underlying assets of the options must be the same. The charts below show an example of collar strategies.Top

|

|

| Long Collar |

Short Collar |

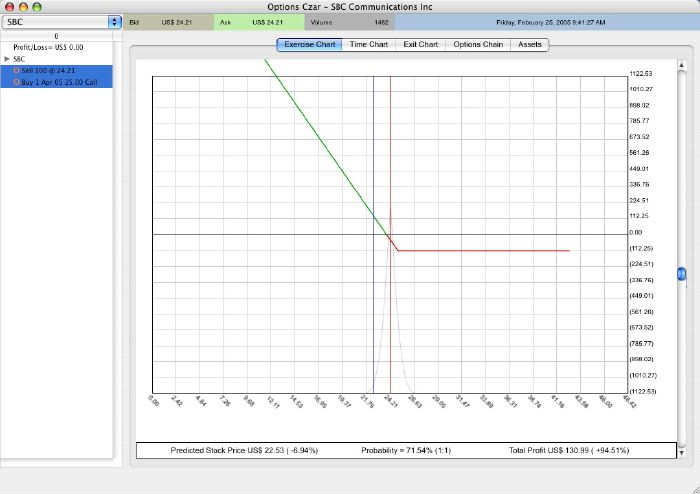

- Covered Call strategy Also known as covered write, this strategy consists of the sale of stock accompanied by the purchase of one Call option for each 100 underlying shares. The chart below shows how the downside of the short sale (if the stock price increases after the sale) is compensated by the call option that was purchased. Top

- Equity Options Options whose underlying asset are company shares.Top

- European Options Options that can only be exercised on the expiration date.Top

- Exercise (or Strike) Price For Call options, this is the minimum price of the underlying asset for which an option can be exercised. For a put option, it is the maximum price of the underlying asset for which the option can be exercised.Top

- Expiration or Maturity Date after which an options contract is no longer valid.Top

- In-the-money option Option in which the stock market price has exceeded (in case of a call option) or fallen below (in case o a put option) the exercise price. The chart below shows an example of a Call option in-the-money. Note that for a call to be in-the-money, the current asset value needs to intersect the slope, not necessarily the green (profitable) area.Top

- Intrinsic Value The economic value if exercised immediately. An in-the-money option has an intrinsic value.Top

- LEAPs Long term Equity AnticiPation securities. Options on stocks with an expiration date beyond the three-month standard period. The current version of Options Czar does not work with LEAPs and ignores the data from the downloaded data file. LEAPs is a trademark of the CBOE.Top

- Long Position A Long options position is that of the person that has the right to exercise it. For example, if an investor buys the call, he/she is in the Long position while the writer (or seller) is in the Short position. Top

- OCC The Options Clearing Corporation is the issuer and registered clearing facility for all U.S. exchange-listed securities options. For more information, visit the OCC web page.Top

- Option Contract that gives the buyer the right (but not the obligation) to buy or sell an underlying asset at a specified time and a specified price.Top

- Out-of-the-Money Option Option where the underlying asset price is lower (in case of a Call Option) or higher (in case of a Put Option) than the exercise or strike price of the option. Note that the current asset price interescts the horizontal section of the curve. Top

- Option Premium or Price Payment that has to be made to own an options contract. For examples on how to calculate Options prices, consult the bibliography.Top

- Protective Put Option strategy where the investor owns or buys stock and one Put Option for every 100 shares of the underlying stock. This strategy protects from a fall in the stock price while allowing profits in case the stock price increases. The Profit/Loss curve (shown below) is similar to the purchase of a Call option. Top

- Put Contract that gives the owner the right (but not the obligation) to sell an underlying asset.Top

- Straddle options strategy Strategy where the investor buys (long straddle) or sells (short straddle) a Call and a Put option with the same underlying asset, strike prices and expiration dates. A long Straddle is for the investor that is expecting a high volatility, while a short Straddle benefits the investor when the stock presents a low volatility. Top

|

|

| Long Straddle |

Short Straddle |

- Strangle options strategy (Long Strangle) In this strategy, the investor buys a Call and a Put, both out of the money. (Short Strangle) The investor sells a Call and a Put, both out of the money. Both Options require the same expiration date and underlying asset. See examples below. Top

|

|

| Long Strangle |

Short Strangle |

- Time Premium Part of the options price or premium that reflects the time to expiration of the option. For example, all else equal, a call option that expires in November will cost more than a call option that expires in October.Top

- Writer of Option Entity that sells the Option contract.Top

BIBLIOGRAPHY

- FABOZZI, F., MODIGLIANI, F. AND FERRI, M. (2001): "Foundations of Financial Markets and Institutions", Third Edition, Prentice-Hall.

- HAUG, ESPEN GAARDER (1998): "The complete guide to options pricing formulas", First Edition, McGraw-Hill.

- BREALEY, R. AND MYERS, S. (1996): "Principles of Corporate Finance", Fifth Edition, McGraw-Hill.

|